Buying a life insurance cover alone will not

necessarily ensure that your loved ones get the insurance amount in the event

of your death. If you are the owner of a business with a high component of

loans and have accumulated debts, your creditors will have the first claim on

your policy proceeds. To protect your loved ones from such situations insure yourself

under MWPA. To read more visit http://www.investmentyogi.com/insurance/married-women-s-rights-amp-empowerment-indian-property-law.aspx

About Me

- Vandana Dubey

- A Certified Financial Planner by qualification and a corporate trainer by profession, wants to create awareness about personal finance and management mainly to educate people in general about how to manage their financial needs and attain financial freedom. Write to me at vandanadubey@yahoo.com

Monday, July 22, 2013

Monday, June 10, 2013

The Penny Stock Fallacy

According

to a recent Economic Times report nearly 200 penny stocks, which were never

traded since 2000, have seen a resumption of trading on the BSE in the past one

year and some of these stocks have appreciated between 100 per cent and 1000

per cent; months after making a comeback, while a few of them hit the upper

circuit successively over the period. Moral of the story; if there is any one

type of stock which is still dazzling in this choppy market, it is the penny

stock. With the recent fall in the stock market along with brighter future

projections make a lucrative combo, with high growth potential.

Impressive!! Now what is a penny stock?

A stock which is generally sold at less than 10% of its offer value and sold

below par.

Two

common beliefs pertaining to stocks market are that many of today's stocks were

once penny stocks and that there is a positive correlation between the number

of stocks a person owns and his or her returns. While many of today’s bluechips

once started small, the exponential growth they witnessed was based on strong

fundamentals and sound business models. Plus for every one hit you also have

ten or more misses.

Investors

who have fallen into the trap of the first fallacy believe Wal-Mart, Microsoft

and many other large companies were once penny stocks that have appreciated to

high rupee values. Many investors make this mistake because they are looking at

the "adjusted stock price," which takes into account all stock

splits. Rather than starting at a low market price, these companies actually

started high, continually rising until they needed to be split.

The

second reason that many investors may be attracted to penny stocks is the

notion that there is more room for appreciation and more opportunity to own more

stock. If a stock is at 10 paise and rises by five paise, you will have made a

50% return. This, together with the fact that a Rs1,000 investment can buy

10,000 shares, convinces investors that penny

stocks are a rapid, surefire way to increase profits. Want to invest in

the IT sector? With Rs 7,500 you can buy three shares of Infosys

Technologies—or 3,000 shares of Software Technology Group. The very thought

that they can buy 1,000 times more shares makes many investors walk into the

trap of penny stocks.

Unfortunately,

people tend to see only the upside of penny stocks, while forgetting about the

downside. A ten paisa stock can just as easily go down by five paisa and lose

half its value. Most often, these stocks do not succeed, and there is a high probability

that you will lose your entire investment.

The

price may be low, but the mistake of investing in a penny stock can be very

costly. Infosys has risen in value and enriched investors with dividends and

bonus issues. The last time that Software Technology Group was trading above Rs

10 was in September 2009. The company has been in losses for the past two years

and has no reserves.

Now

you know why one is trading at Rs 2,500 and the other at Rs 2.50. There is a

greater chance of Infosys rising by Rs 500 than the Software Technology Group

by 50 paise. Besides, the average daily traded volume of Infosys in the past 30

days is 11 lakh shares. Only 2,800 shares of Software Tech have been traded

daily. Even after taking into account the current challenges that Infosys

faced, it still stands head and shoulders above almost all of the penny stocks

floating in the market.

Penny

stocks aren't a lost cause, but they are very high-risk investments that aren't

suitable for all investors. If you can't resist the lure of penny stocks, make

sure you do extensive research and understand what you are getting into. After

all it’s like searching diamond in scrap; someone might get lucky. Do your

homework well and consider limiting your exposure to a maximum amount, over

which you would risk losing your sleep. Stay Blessed!!

Monday, December 31, 2012

Some Financial Resolutions for 2013

Came across a post on the Facebook “friends

don’t let friends eat any sweets in 2013; need to lose 10 lbs”. Comes New Year,

along come lot of resolutions; some about weight, some about vices but none

about wealth and my resolution for the New Year is to put people on the right financial

track. In fact as we ring in the New Year, here are certain things that

are guaranteed to secure and grow your wealth in the coming year.

Ø Review

and Analyse

Having clearly chalked out your financial plans is the

beginning but your short term goals may change due to changes in your lifestyle

or circumstances, such as an inheritance, marriage, birth, house purchase or

change of job status and that can interfere with your medium and long term

goals. It’s very important to revisit and revise your financial plans so that

you stay on the track with your long term goals. A yearly review is important

to know how various investments are doing. Besides identifying the laggards

that should be trashed, it also tells you if you need to rebalance. It is often

difficult for us to review our financial plans without being emotional. Best

seek professional help and higher a financial planner.

Ø Do

not stagnate in a bad job

Though the job market is not too promising do not allow yourself to get

stagnated if you are unhappy with the current assignment. Upgrade your skills,

and explore options.

Ø Mind

your debt

People seldom realise that they are headed for a debt trap till they are

actually trapped in it. Learn to differentiate between a good loan and a bad

loan. A good loan is one which adds more value than it takes away. Home loan

and education loans are good loans. You get tax benefit too on the repayment of

these loans. Stay away from personal loans. They are bad, expensive and basically

rip you apart. I know people who’ve availed personal loans for a mere foreign

trip, trust me it’s a bad idea. Credit card these days is synonymous for

convenience but convenience comes with a price attached to it. You have a

period of 45 to 50 days which is a zero interest period; there after the

charges are approximately 3% per month or 43% per annum because it is

compounded, not to forget the service charges. Horrendously expensive! So

if you succumb to the pleasures of using a credit card often, it’s time now to

start using it judiciously. Also if your EMIs are more than 25% of your income

than it’s a matter of great concern..

Ø Buy

Insurance.

Forget income tax benefit and return oriented plans. Buy a pure term

plan and secure the future of your dependents. The best time to buy insurance is

today because you get insurance only when you are in good health. It’s a

privilege. Everybody does not get insurance. For more details on the quantum of

insurance amount read http ://vandana-dubey.blogspot.in/2011/12/how-much-insurance-do-you-need.html

Ø Do

not get lured by high returned schemes

Do

resolve to stay away from schemes assuring more than 20% returns per month.

There is either some magic or more likely some scam. In that case the best way

to double your money would be to fold it and keep it in your pocket. Be an

investor. Do not speculate.

Ø Plan

for the Retirement

I

know most of us haven’t given it a thought yet; but it’s never too early or

never late to start planning for the retirement. The National Pension Scheme

(NPS) can be a useful tool. Also do not forget to transfer your PF balance when

you shift jobs. It could be the cheapest way of saving for your retirement. Most

of us either ignore it or withdraw it and spend it. Do not ignore it as the

corpus would not fetch any interest after three years.

Last but not the least, it is

indeed tempting to buy that trendy tablet or fabulous smart phone; do ask

yourself; do I really need one? You could be doing that at the cost of other

important financial goals. More on this to follow later. Till then Stay

Blessed!! Happy 2013!!

Sunday, November 25, 2012

Some Myths Associated with Mutual Funds

Mutual funds are an effective

engine to route your investments in the equity markets. They offer several

advantages over direct stock picking; but even after knowing the importance of

investing in mutual funds, many people refrain from this instrument due to

several myths. I have observed even informed investors making incorrect

investment decisions based on incorrect or flawed information. I find it hilarious when

people ask me the #1 fund. One gentleman went to the extent of asking me the

best funds as he wanted to do SIP for 1 year only; so the best fund would give

him the best returns.

Let’s debunk these myths once and for all.

Myth 1: Funds with more

stars/higher rankings make better buys.

Reality: The rankings and ratings

are based on the past performances; and they do not ensure the future

performance at all. At best, rankings and ratings can serve as starting

points for identifying a broader set of "investment-worthy" funds.

But investing in a fund based solely on its ranking/rating would be

inappropriate

Myth 2:

A fund with a net asset value (NAV) of Rs 10 is cheaper and so, more attractive

than a fund whose NAV is Rs 50.

Reality: Fund

A's NAV is higher than fund B's because the former has been around longer and

had bought the script much earlier, which itself saw some appreciation. Any

subsequent rise and fall in the NAVs of both these funds will depend on how the

script moves. A mutual fund's NAV represents the market value of all its

investments. Any capital appreciation will depend on the price movement of its

underlying securities. Say, you invest Rs 1,000 each in a new fund, A (whose

NAV is Rs 10) and an old fund, B (the NAV is Rs 50). You will get 100 units of

fund A and 20 units of fund B. Let's assume both schemes have invested their

entire corpus in just one stock, which is quoting at Rs 100. If the stock

appreciates by 10%, the NAV of the two schemes should also rise by 10%, to Rs

11 and Rs 55, respectively. In both cases, the value of your investment

increases to Rs 1,100.

Myth 3:

Children's mutual fund schemes are ideal to assure a child's future.

Reality:

MF children schemes work like any other MF scheme and their returns depend on

the performance of the markets. Since most of these schemes are long term, your

returns are optimized.

Myth 4:

Funds that regularly declare dividends are good buys.

Reality:

Fund houses declare dividends when they have distributable surplus. However,

there are times when a fund manager declares dividends if he does not have

adequate investment opportunities. Under worse conditions, a fund manager may

sell some good stocks to generate surplus for dividend distribution. The motive

is to attract investors.

Mutual Funds can only pay out

dividends if they have made gains on the portfolio. Dividends are like

fruits on a tree...If you do not give enough time for the tree to grow where

will the fruits come from?

It's important

to note that a mutual fund dividend is not an additional benefit. The sum just

gets deducted from the NAV of the fund and is paid to the investor. See it as a

periodic profit booking, not as an additional gain as in the case of stock

dividends. A mutual fund dividend is your own money being returned to you. Your

investment gets depleted to that extent. If your fund has an NAV of Rs 50 and

declares a 20% dividend (Rs 2 on a face value of Rs 10), the NAV of the fund

will fall to Rs 48 after the dividend is paid.

Myth 5:

A balanced fund is always equally balanced in a 50:50 ratio.

Reality: No this not the case. Balanced funds

aim to achieve a balance between equities and debt; and this would depend on

the nature of the fund. Equity oriented balanced funds typically invest at

least 65% in equities and the rest in debt; others do this in a 40:60 ratio.

Myth 6: I can do better than the fund manager.

Reality: Like every industry, the MF industry has its share of good and bad fund managers. In the past 10 years, large-cap funds returned 19.21% on average. Despite the worst performing large-cap fund in the past 10-year period returned 7.70%, the top five funds returned 29.11% on average. Most of these funds have been around for more than 10 years and their individual corpuses have grown from Rs500 crores to more than Rs3,000 crores.

While it’s tough to beat the markets consistently—with the kind of corpuses MFs manage—you may avoid the MF route if you think you can navigate the markets on your own. For the rest, I’d suggest the MF bus, preferably through an SIP.

More on mutual funds would follow soon. Till then happy investing!! Stay Blessed!!

Sunday, September 16, 2012

Magic Of SIP

Remember the story of the thirsty

crow? I heard it in my childhood and have read the same story to my son umpteen

number of times. The smart crow kept on dropping the pebbles into the half

filled pitcher till the water level came up. Birla Sun life Mutual Fund has

very appropriately used this story in it’s advertisement to promote SIP. They

say a smarter way to save regularly. Yes it is. There cannot be a better way of

explaining the benefits of SIP.

The SIP or the Systematic

Investment Plan works exactly in the similar manner. It simply means investing a fixed amount of money at regular intervals say a quarter or a month, with a clear financial goal in mind. You keeping putting in money just like the

pebbles till you reach the desired goal.

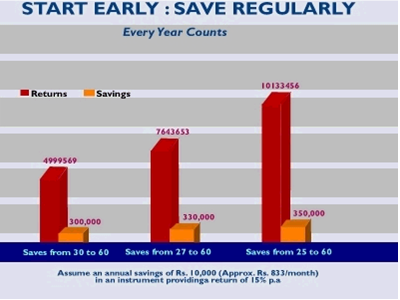

Let’s understand this with an

example. In this example three gentlemen A, B and C who are 30, 27 and 25 yrs

old respectively; decide to save for their retirement at 60. Assuming an annual

saving of Rs10000/- (approximately Rs.833/- per month) in an instrument providing

a return of 15%; all three of them land up putting in 300000/-, 330000/- and

350000/- respectively. There is difference of only Rs 50000/- between the

amount put in by A and the amount put in by C; however there is a whopping

difference between Rs 4999569/- and Rs10133456/- received by them at the age of

60 yrs. This is power of compounding.

Another advantage of SIP is Rupee

Cost Averaging. In RCA or Rupee Cost Averaging a fixed number of shares are

bought irrespective of the price; more shares are bought when the price is low

and vice versa. Eventually, the average cost per share becomes smaller and

smaller and this helps you gain better overall profits as the market increases

over the long term. It’s a long term strategy, and one has to keep in mind the

smart working done by the thirsty crow. More on this to continue. Till then

Happy SIPPING!! Stay blessed!!

Sunday, July 22, 2012

Euro Crisis: Impact On India

The

adage that America sneezes and the world catches flu held true in 2008.It was

the huge subprime crisis in the US that triggered the last recession and

engulfed the world; this time around

it is the countries in Europe which are sending shivers. Enough has been already spoken and written about the Euro crisis and its causes, but my concern is with the impact it has on us.

Firstly it’s

affecting us through the monetary route as euro is losing value, dollar is

becoming more expensive. This, in turn, means Indian currency is losing

value against dollar. Our large trade

deficits, resulting from imports being far greater than exports, have made the

things worse as the trade is funded with large buying of dollars. One of the

main reasons for the last petrol price hike was the fall in rupee making

imports costlier.

Secondly,

hike in the interest rates by the RBI as a counter inflationary measure has

already jeopardised Indian industry

and led to a slowdown in credit off take from banks. The purpose of taming the

rising inflation was not served but it led to a further slowdown in investments

and industrial growth. Growth in

industrial production slipped to a 21-month low of 3.3 per cent in July 2011.

The country’s economic growth also moderated to 7.7 per cent during the

April-June quarter this fiscal, the slowest growth in six quarters.

The

market has already slowed down. When the economic growth slows down, a country

also becomes unattractive for investment. No wonder the foreign direct

investment (FDI) in the country has dropped significantly in the last few

months and the stock markets are seeing flight of foreign capital as the FIIs

are selling their holdings in hoards. A slower growth would mean

lower asset prices and lower income growth. On the positive side, the commodity

prices will come down. A beginning perhaps has already started which will bring

down inflation and may allow RBI to cut rates. Lower rates will help demand and

may allow growth to stabilize. Investors in equity and equity-related products

will have to be very careful of what they are buying, while domestic debt

investors may choose to lock into higher yielding safe products as interest

rate may fall sharply. Now in such a scenario what should an investor do? My sincere

advice is to remain invested. However should you decide to buy or sell; here

are some simple rules which should help you in this regard.

1. Do not wait for the highest price.

Obviously

you would want the best possible price for your shares but how would you know

that a particular share has reached its peak? Sell as soon as you have made

adequate profits on your investments. Most successful investors get excellent

returns by buying and selling in intermediate range prices.

2. Sell a share when your target price is reached.

When

you buy the shares of a particular company, you do so with a certain goal in

mind. For example you may have bought some shares with the intention of

doubling your investment in two years. I suggest you sell the shares the moment

you reach, or cross your target. You may fee that you have missed out on the

opportunity of making more money if the prices continue to rise; however, you

should also keep in mind the converse possibility.

In

such a situation sell your shares immediately, even if it means incurring a

substantial loss. There is no point in holding on in the vague hope that things

may eventually improve; wishful thinking is not the way to get rich in the

stock markets. Understand the importance of cutting your losses.

The

price earnings ratio (P/E) expresses the relationship between the market price

of a company’s share and it’s earning per share. In other words it’s a

reflection of the market’s opinion of the earning capacity and future business

prospects of a company. Companies which enjoy the confidence of the investors

and have a higher market standing usually command high P/E ratio.

The

highest and the lowest prices recorded by a particular share in the previous

year are helpful in providing a frame of reference for judging its current

price. If you pick up a sound growth share at around its previous year’s lowest

price or even at previous year’s average price then chances are that you are

buying it at the right price.

6. Understand booms and recessions.

Booms and recession are cyclical phenomena; neither lasts forever. A boom means that the economy has over extended itself and a correction in the form of recession becomes due in order to restore the balance. A boom is the time to sell the shares and a recession is the appropriate time to buy at cheap prices. At such times most shares are grossly under priced, so almost any share you buy will give you an excellent return on investment once the economy pulls out of the recession. More on this would follow later; till then happy investing!! Stay Blessed!!

6. Understand booms and recessions.

Booms and recession are cyclical phenomena; neither lasts forever. A boom means that the economy has over extended itself and a correction in the form of recession becomes due in order to restore the balance. A boom is the time to sell the shares and a recession is the appropriate time to buy at cheap prices. At such times most shares are grossly under priced, so almost any share you buy will give you an excellent return on investment once the economy pulls out of the recession. More on this would follow later; till then happy investing!! Stay Blessed!!

Sunday, May 27, 2012

Reverse Mortgage: The Loan That Pays You!

Mrs. Sharma is a

62 yrs old widow living all by herself in a house built by her husband but the

pension that she gets is not enough to bear her livelihood expenses and she

hates to ask for the financial help from her children. Getting into old age

without proper financial support can be a very bad experience. The rising cost

of living, healthcare, other amenities compound the problem significantly. No

regular incomes, a dwindling capacity to work and earn livelihood at this age

can make life miserable. A constant inflow of income, without any work would be

an ideal solution, which can put an end to all such sufferings. But is it

possible?

According to Oasis (Old Age Social and Income

Security Project) report, only 4% Indians are financially independent at the

age of 60; and 90% of our senior citizens live in poverty. Old age can be very

challenging or rather miserable when there is no support from any source.

I strongly

believe that creating a nest egg for a comfortable retirement is absolutely

necessary and sooner one starts better it is; however, the fact is some people

think everything will ‘just turn out ok’ and they make no concentrated effort

towards planning for their retirement. On the other hand, it may not be a

feasible thing to do for many; who have other loads of expenses. Does it mean one should lead a life of penury

and be a popper in the sunset years? No certainly not. Reverse mortgage is the

silver lining in the dark cloud; and is especially useful if one has not saved

enough for the retirement and for people who are brick rich but cash poor.

If you are

looking for a regular tax free source of regular income after retirement you

don’t have to look beyond the four walls of your house. Reverse mortgaging your

house can get you a regular income in your old age. Banks are willing to give

loans against property to senior citizens. In return, the bank becomes a part

owner of the house. In this way, cash-strapped senior citizens can unlock the

value of their property without actually selling it.Though the

concept is very common in developed markets, reverse mortgage has not picked up

in our country where real estate also has an emotional value. People love their

homes so much that they cannot bear the thought of selling the property.

It's time to get rid of this misconception about reverse mortgage. If an owner

puts up his house for reverse mortgage, it does not mean he has sold it. He has

merely taken a loan against it. The property is revalued every five years, and one

can expect a higher income after the revaluation of the property as and when

the value appreciates. After his death, his legal heirs will have the option to

either repay the loan along with the interest and regain the property or let

the bank sell it and give them the proceeds after deducting the borrowed

amount.

This is how

reverse mortgage works:

It’s opposite of

home loan; instead of paying the EMI the person gets the lump sum or monthly / quarterly / annually pay out from

the Bank. The lump sum can be deposited in the borrower’s bank account and can

be withdrawn as per requirement. The owner can borrow up to 60% of the value of

the property; and since money received is a loan, its tax free. And the

property is revalued every five years; one can expect a higher income after the

revaluation of the property.

After owner’s

death his heirs will have the option to repay the loan along with the interest

and regain the property or let the bank sell it and give them the proceeds

after deducting the borrowed amount. Only senior citizens can avail of reverse

mortgage and they should be living in the house that is being mortgaged. Don’t

compromise on the quality of life. Stay Happy!! Stay Blessed!!

Subscribe to:

Posts (Atom)