Came across a post on the Facebook “friends

don’t let friends eat any sweets in 2013; need to lose 10 lbs”. Comes New Year,

along come lot of resolutions; some about weight, some about vices but none

about wealth and my resolution for the New Year is to put people on the right financial

track. In fact as we ring in the New Year, here are certain things that

are guaranteed to secure and grow your wealth in the coming year.

Ø Review

and Analyse

Having clearly chalked out your financial plans is the

beginning but your short term goals may change due to changes in your lifestyle

or circumstances, such as an inheritance, marriage, birth, house purchase or

change of job status and that can interfere with your medium and long term

goals. It’s very important to revisit and revise your financial plans so that

you stay on the track with your long term goals. A yearly review is important

to know how various investments are doing. Besides identifying the laggards

that should be trashed, it also tells you if you need to rebalance. It is often

difficult for us to review our financial plans without being emotional. Best

seek professional help and higher a financial planner.

Ø Do

not stagnate in a bad job

Though the job market is not too promising do not allow yourself to get

stagnated if you are unhappy with the current assignment. Upgrade your skills,

and explore options.

Ø Mind

your debt

People seldom realise that they are headed for a debt trap till they are

actually trapped in it. Learn to differentiate between a good loan and a bad

loan. A good loan is one which adds more value than it takes away. Home loan

and education loans are good loans. You get tax benefit too on the repayment of

these loans. Stay away from personal loans. They are bad, expensive and basically

rip you apart. I know people who’ve availed personal loans for a mere foreign

trip, trust me it’s a bad idea. Credit card these days is synonymous for

convenience but convenience comes with a price attached to it. You have a

period of 45 to 50 days which is a zero interest period; there after the

charges are approximately 3% per month or 43% per annum because it is

compounded, not to forget the service charges. Horrendously expensive! So

if you succumb to the pleasures of using a credit card often, it’s time now to

start using it judiciously. Also if your EMIs are more than 25% of your income

than it’s a matter of great concern..

Ø Buy

Insurance.

Forget income tax benefit and return oriented plans. Buy a pure term

plan and secure the future of your dependents. The best time to buy insurance is

today because you get insurance only when you are in good health. It’s a

privilege. Everybody does not get insurance. For more details on the quantum of

insurance amount read http ://vandana-dubey.blogspot.in/2011/12/how-much-insurance-do-you-need.html

Ø Do

not get lured by high returned schemes

Do

resolve to stay away from schemes assuring more than 20% returns per month.

There is either some magic or more likely some scam. In that case the best way

to double your money would be to fold it and keep it in your pocket. Be an

investor. Do not speculate.

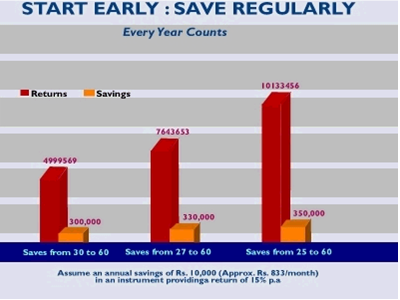

Ø Plan

for the Retirement

I

know most of us haven’t given it a thought yet; but it’s never too early or

never late to start planning for the retirement. The National Pension Scheme

(NPS) can be a useful tool. Also do not forget to transfer your PF balance when

you shift jobs. It could be the cheapest way of saving for your retirement. Most

of us either ignore it or withdraw it and spend it. Do not ignore it as the

corpus would not fetch any interest after three years.

Last but not the least, it is

indeed tempting to buy that trendy tablet or fabulous smart phone; do ask

yourself; do I really need one? You could be doing that at the cost of other

important financial goals. More on this to follow later. Till then Stay

Blessed!! Happy 2013!!