Remember the story of the thirsty

crow? I heard it in my childhood and have read the same story to my son umpteen

number of times. The smart crow kept on dropping the pebbles into the half

filled pitcher till the water level came up. Birla Sun life Mutual Fund has

very appropriately used this story in it’s advertisement to promote SIP. They

say a smarter way to save regularly. Yes it is. There cannot be a better way of

explaining the benefits of SIP.

The SIP or the Systematic

Investment Plan works exactly in the similar manner. It simply means investing a fixed amount of money at regular intervals say a quarter or a month, with a clear financial goal in mind. You keeping putting in money just like the

pebbles till you reach the desired goal.

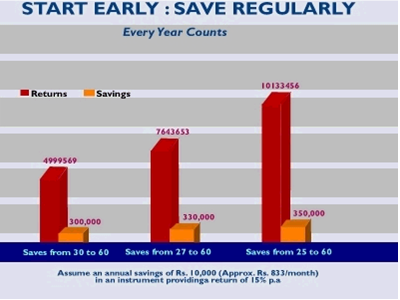

Let’s understand this with an

example. In this example three gentlemen A, B and C who are 30, 27 and 25 yrs

old respectively; decide to save for their retirement at 60. Assuming an annual

saving of Rs10000/- (approximately Rs.833/- per month) in an instrument providing

a return of 15%; all three of them land up putting in 300000/-, 330000/- and

350000/- respectively. There is difference of only Rs 50000/- between the

amount put in by A and the amount put in by C; however there is a whopping

difference between Rs 4999569/- and Rs10133456/- received by them at the age of

60 yrs. This is power of compounding.

Another advantage of SIP is Rupee

Cost Averaging. In RCA or Rupee Cost Averaging a fixed number of shares are

bought irrespective of the price; more shares are bought when the price is low

and vice versa. Eventually, the average cost per share becomes smaller and

smaller and this helps you gain better overall profits as the market increases

over the long term. It’s a long term strategy, and one has to keep in mind the

smart working done by the thirsty crow. More on this to continue. Till then

Happy SIPPING!! Stay blessed!!